Supply chain analytics provide valuable insight into your company’s operational tempo — how quickly you deliver products and services to your customers — but marketing analytics help you see the bigger picture of customer behavior by bringing your supply chain reports, charts and graphs to life.

In brief:

- Supply chain analytics alone miss the customer story. While they track operational metrics like inventory turnover, they don’t reveal the customer behaviors driving those numbers.

- Combined analytics deliver major benefits, including enhanced demand forecasting, personalized customer experiences, operational efficiency, optimized product placement, better pricing strategies, and improved crisis management.

- Group customers by behavior patterns — not only demographics — to identify underserved markets and revenue opportunities.

- Use integrated business planning, shared dashboards, and regular cross-team meetings to align supply chain and marketing efforts.

- Artificial intelligence (AI) amplifies the impact. Predictive analytics improve demand forecasting accuracy and can identify segmentation patterns that humans might miss.

Why do customers buy your products — and what will they buy next year? Marketing tools like customer surveys can provide partial answers, but quality and speed of delivery also affect customer buying habits, especially with today’s Google reviews and other influential customer feedback platforms. Combining supply chain analytics with marketing analytics provides a fuller picture, especially with customer segmentation in the mix.

Segmentation groups customers by behavior patterns rather than basic demographics, which encourages supply chain and marketing teams to collaborate more effectively.

With artificial intelligence (AI) now making it easier to integrate marketing and supply chain analytics, organizations can transform their supply chain analytics tools from reactive reporting systems into proactive revenue drivers.

To understand how this transformation works, let’s first establish clear definitions of both analytics approaches.

How We Define the Analytics Landscape

Supply chain analytics is the use of data analytics, methodologies, and tools for analyzing the enormous amounts of data generated by the modern supply chain to understand customer buying trends, spot inefficiencies, and show the workings of every part of the supply chain.

The data comes from many sources — including procurement systems, inventory management, product design and manufacturing, logistics, and customer sales and marketing tools.

It helps many industries, such as automotive, where predictive analytics in supply chain management can analyze web interactions and customer data to discover emerging product preferences, or the food and beverage industry, where analytics ensures higher food safety and quality by making it easier to trace orders as they’re processed, packaged, shipped, and delivered.

Ultimately, supply chain analytics examines how well customer expectations are met (for example, on-time, in-full delivery or customer complaints) and how cost-efficient product or service delivery is. (Measures include inventory turnover, freight cost per unit, and direct labor hours per unit produced.)

Marketing analytics is the measurement, management and analysis of marketing performance data (such as conversion rate, net promoter score, and customer acquisition cost) to get the best return on investment (ROI) from those efforts, shape marketing strategy, and foretell market trends.

“Marketing analytics can unveil the quality of the customer experience at every stage, with data from each touchpoint across every channel,” says Amani Undru, a business intelligence and data strategist who specializes in analytics optimization. “You can use these data-driven insights to deliver an optimized customer experience that promises unmatched value.”

For instance:

- You can use customer data to tailor marketing outreach, as Amazon does in using purchase history and browsing behavior to create customized product recommendations.

- You can use modeling to see what marketing channels yield the most value, as Airbnb did with multitouch attribution that prompted them to revamp their mobile experience after it revealed that customers did their research on a mobile device but their bookings on a desktop computer.

- You can mine predictive analytics insights to anticipate customer requirements, as fast-fashion and cosmetic retailer ASOS does to forecast fashion trends and stock inventory and, consequently, improve customer satisfaction.

These two types of analytics shouldn’t be running on parallel, nonintersecting tracks. Instead, they need to work together.

“People often use the term ‘road map’ when talking about this type of business planning, but it’s more like a ‘flight plan,’” says Centric Consulting’s Experience Design Lead John Tourles. “A flight plan includes up-to-date information about weather, traffic, headwinds, or other dynamic conditions. Together, marketing and supply chain analytics provide data you need to navigate the storms of changing consumer behaviors and supply chain capabilities.”

Customer Behaviors Provide Deeper Insights Into Supply Chain Analytics

It might seem like supply chain analytics should be the central analytics activity in any company with a supply chain.

After all, the data from supply chain transactions can populate everything, including reports, graphs, and dashboards, and provide a sense of how quickly a company is making and spending money — that is, data about the company operations’ pace and how that translates into income and outgo.

However, comingling supply chain data with marketing data can increase business analytics’ comprehensive value by an order of magnitude because it can highlight opportunities for revenue and profit growth.

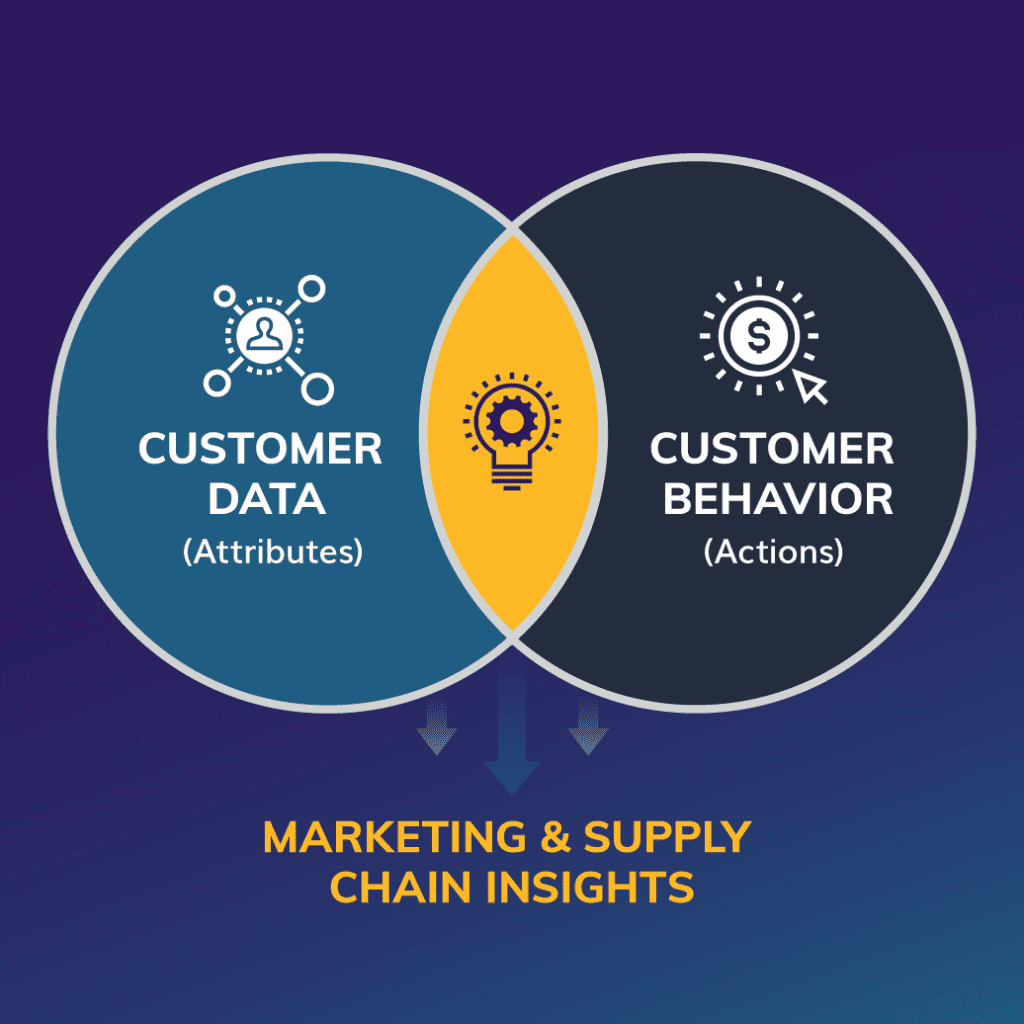

While supply chain analytics includes valuable facts and figures about orders, purchases, inventories, trucks, and warehouses, this is one-sided and siloed information that doesn’t capture what some of these transactions really represent: customer behavior. But by integrating it with marketing data about customer behavior, you can discover marketing insights that make supply chain analytics much more effective.

Here’s how it works. This new data describes particular customer attributes (large versus small, from a particular market segment or across markets, from a particular geography or nation, and so on).

Connecting this information to operational data creates a powerful link between what a customer is and how they behave (order size, order frequency, market basket, rate of payment, and more). This helps marketing and operations (via marketing and supply chain analytics) to better understand and group customers based on similar attributes.

A company can use these insights to grow revenues and profits by identifying underserved customers and markets, plus gaps in products and services.

Combining the data from both analytics resources tells how well your marketing strategy and execution are aligned and if operations is meeting the customer expectations that your marketing group has set. For example, if conversion rates and order fulfillment rates both drop, that can indicate that inventory issues may be hurting sales. The combination of the lead generation data and production planning improves forecasting accuracy.

A hybrid variant on this theme, known as supply market analysis, also applies here. It evaluates supplier capability and capacity measures, such as performance, quality of goods or services, pricing structure, and nimble response to market changes. This way, you can make smart procurement decisions and vendor choices for greater agility and speed.

Let’s look more closely at how this analytics marriage succeeds.

The Benefits of Bringing Supply Chain Data and Marketing Analytics Together

When they’re working in tandem, supply chain and marketing analytics make each other better and make overall business performance that much better, too, in several ways, such as:

Enhanced Demand Forecasting

Supply chain analytics deploys historical sales and market trend data to make production and inventory planning more efficient — and demand forecasting more accurate. Marketing analytics applies that forecast precision to create laser-focused marketing campaigns that better target promotional efforts and increase sales.

Personalized Customer Experience

By providing customer experience data through order fulfillment patterns, delivery times, and returns, supply chain analytics can decipher customer preferences and improve the customer experience. Marketing analytics takes that data to personalize marketing campaigns, target product placements, and match messaging with specific customer segments, which enhances customer satisfaction and loyalty.

Operational Efficiency

Supply chain analytics enlightens marketing strategies about product availability and pricing with data that optimizes inventory management, cuts costs, and simplifies logistics. This information enables marketing analytics to coordinate promotional campaigns with available stock, which prevents overstocking or stockouts and ensures efficient resource distribution.

Product Placement Optimization

The precision forecasts and product demand insights yielded by supply chain analytics help companies understand what products customers want, while marketing analytics can optimize promotional strategies to ensure that products are available when and where promotions are most effective.

More Effective Pricing Strategies

Supply chain analytics can identify where to improve processes to shrink costs and lead times. Marketing analytics can use the data from these actions to offer competitive pricing and differentiate the brand by its superior supply chain performance.

Crisis and Disruption Management

Supply chain analytics insights into supplier performance, logistics efficiency, and potential disruptions empower marketing analytics to develop marketing strategies that account for supply chain capabilities and limitations. Also, predictive analytics in marketing that anticipate changes in customer behavior or market trends can proactively mitigate risk by identifying potential supply chain disruptions.

Segmentation is the foundation for creating this cooperative venture.

How Segmentation Clarifies the Value Add of Marketing and Supply Chain Analytics

Segmentation starts by grouping customers by a logical set of criteria that makes it easier to identify group behaviors. This can be tricky because it often depends upon subjective and relative definitions: What is a large customer? A large order? A long lead time? A large customer, order, or lead time in one company may be a small one in another.

While traditional segmentation is based on these and other customer, order, and lead-time variables, other factors — such as day of the week or time of day — may be pertinent for some businesses, too.

Beyond that, you need a threshold that separates a large customer from a large order or long lead time from a medium one. Again, it’s challenging, but getting this done enables a new perspective. You can detect patterns and behaviors within and across groups, develop generalizations and rules, identify trends and outliers, and formulate plans, actions, and policies.

For example, Tourles once worked for a company that distributed food and beverage products to restaurants and retailers. He identified a trend in the marketing analytics that indicated customer dissatisfaction in certain areas across the state.

Tourles conducted a segmentation analysis based on customer size, product mix, order frequency, and other criteria. This revealed that the dissatisfied customers were generally smaller accounts with lower order volumes, but many similar customers reported high satisfaction levels.

Deeper analysis found the dissatisfied customers were predominantly located in rural areas, farther from the standard delivery routes.

“We integrated marketing insights with operational data from our delivery network to pinpoint the logistical challenges contributing to the issue,” Tourles says. “This cross-functional collaboration allowed us to develop and implement targeted solutions to improve service levels for these customers.”

Sharing Data Between Marketing and Operations Drives Collaboration

While marketing organizations frequently possess the necessary data to perform a respectable segmentation, the formats they use seldom promote collaboration.

A food and beverage corporation could overcome this challenge, for example, by changing that “Walmart and Everything Else” segmentation into one that breaks out groups such as:

- Integrated, big box, full-service grocers

- Large footprint national grocers

- Large footprint regional grocers

- Small footprint regional grocers

- Small footprint local grocers

A cross-functional team can really work with this customer grouping to analyze behaviors, develop insights, and capitalize on opportunities. The upshot of this more granular breakdown is a greater understanding of customer demand and a sharp focus on efforts to grow customer satisfaction.

To understand customer behaviors, a team should review:

- Products ordered together in a single transaction (market basket)

- Products ordered over time (time-phased market basket)

- Order frequency and timing (time between orders, requested lead time)

- The quantity of products ordered (product quantities and number of order lines)

- Invoices and payments (timeliness, completeness)

- Customer returns and complaints (customer satisfaction)

You can drive even more collaboration and alignment between marketing and supply chain by regularly analyzing this combined data to ensure that plans, projects, and policies are effective.

This sustainable process requires cross-functional expertise among supply chain management, marketing, and business intelligence (BI) teams. By automating data extraction, translation and normalization, report generation, and information visualization, the BI team can free up the combined marketing and supply teams to identify and prioritize opportunities.

This hints at the human element necessary for collaboration, one that requires marketing and supply chain teams to talk to each other.

The People Factor in Supply Chain and Marketing Analytics Collaboration: 6 Steps for Success

Encouraging cooperation is a multistep process. Let’s break it down:

1. Establish Measures

Ensure that measures align with the company vision that senior leaders have established. Such measures include:

- Joint product development, where product managers develop and manage products that address customer needs and deliver value, while marketing teams promote those products and drive customer acquisition.

- Open communication, where information sharing between supply chain and marketing teams helps identify and meet challenges and opportunities.

- Cultural alignment fosters a culture of collaboration between marketing and supply chain teams, eliciting more innovation in service delivery, product development, and process improvement.

2. Adopt Sales and Operations Planning

Adopt sales and operations planning (S&OP) to align demand, supply, and financial planning. Managed as part of a business’s master planning, S&OP helps executives make decisions about material and financial plans.

3. Get Leadership Buy-In

Confirm that the mid-level leadership from both sides trusts the data and relies on those metrics to drive the business.

4. Track Key Metrics

Set up recurring meetings where the two teams can review their metrics, look for trends, and investigate the impact of one group’s actions on the other. You can enhance this last initiative by having the supply chain and sales teams create shared dashboards that track those key metrics, such as inventory levels, demand forecasts, and sales performances.

5. Collaborate Early and Often

Involve both teams early in the product creation cycle through collaborative product development (CPD). In CPD, the sales team’s insights about customer needs combine with the supply team’s efforts to efficiently execute those ideas in sourcing, production, and distribution in order to move new products to the market more quickly.

6. Implement Demand Shaping

Implement demand shaping to actively sync customer demand with unforeseen supply chain disruptions. For example, say your company produces a deluxe and standard version of your product. If a tropical storm knocks out the factory that makes the deluxe version, you might adjust your advertising to promote only the standard version until the deluxe version is available again.

Because AI is making supply chain operations more effective and enhancing segmentation capabilities, it can help integrate supply chain and marketing analytics.

AI’s Role in Making Supply Chains More Proactive and Responsive

Artificial intelligence predictive analytics improve demand forecasting by highly efficiently analyzing historical data and trends. It recognizes past patterns and proactively predicts future trends and disruptions.

Analyzing larger datasets, such as weather patterns, holidays, market shifts, and supplier disruptions, enables AI to build predictive models to improve demand forecasting’s precision.

Case in point: Walmart uses AI to accurately predict customer demand by analyzing weather patterns, seasonal trends, local events and historical sales data. Understanding these macro-weather and macro-economic shifts, alongside local demographics, allows Walmart to ensure the right quantity of products in their stores.

AI also helps companies establish more reliable sourcing — and make more informed purchasing decisions — by considering the impact of supply chain disruptions, such as natural disasters or strikes, on the supply chain.

By tasking AI with finding alternative suppliers during shortages, industry, infrastructure, and transportation technology company Siemens was able to locate distributors for a patented product that was difficult to find. This made the product available to customers when they wanted and needed it.

Specifically, Siemens turned to Scoutbee to search import and export documents to cope with a shortage of Surlyn, a very specialized ionomer resin that is used to package medical diagnostic products. Within days, Scoutbee came up with a list of 150 Surlyn distributors, Siemens edited the list down, and Scoutbee found several distributors on that shortlist with inventory that Siemens could readily purchase.

Refining Segmentation Analysis

While human beings consider segmentation groupings according to logical parameters that occur to them, AI doesn’t distinguish between what is and isn’t logical. As such, AI can help conduct a segmentation analysis by poring through available data and identifying factors that people might not have considered.

For example, AI might find that when an order is delivered on time, in full, to a customer five consecutive times, they’re much more likely to convert to an auto-ship order. While a person might have uncovered this — if they were looking for it — it might have taken a lot of time to do that, whereas AI instantaneously discovered this information.

And then, what happens if a few months later, the customer wants to switch to auto-ship after only three consecutive on-time, in-full orders? AI would alert the shipping department to that fact.

In Analytics Unity, There Is Strength

It’s clear, then, that it’s necessary and beneficial to expand on the supply chain analytics that measure how well company performance satisfies customer needs with the marketing analytics that tell how customers behave and how that impacts the value of their experience. This produces a more efficient, productive, and agile supply chain and a marketing approach that successfully anticipates and delivers what the customer desires.

Our Operational Excellence team works to create scalable, flexible solutions centered on your business needs. Interested in working together to improve your processes? Contact us