Let’s take a look at the steps to take and the challenges you face when trying to launch a new product.

Part three of a series.

After aggregating sales projections and agency input, facilitating brainstorming sessions, studying markets and demographics, analyzing costs and benefits and presenting to executives, a decision has been made to move forward with the next big policy concept. However, based on further requirements and design analysis, project estimates indicate the product will take another two years to roll-out. Does this sound familiar? Unfortunately, this is a common reality for many carriers. And extended delivery periods come with increased risks, such as shifting policyholder preferences and missed opportunities to gain market share.

What does product development success look like? In this series, Centric’s Insurance experts uncover product development challenges. In our last two articles in this series, we defined six common challenges associated with product development, as well as the need for product innovation and creating a culture of innovation.

Start at the top with prioritization

Many strategic initiatives fail to lift off in a timely manner because there are too many competing priorities within an organization. Absent clear and unequivocal direction from executive management, departmental leadership drifts towards items that provide the most direct benefit to their department, which may or may not align with the overarching strategic imperatives. Prioritization is paramount, and clearly aligning strategy, objectives and actions is a critical first step.

Many organizations would claim they align the organization around its priorities, yet projects still struggle. A common cause for lack of alignment is a poor view into resource and capacity management. Are people actually working the right tasks? Resources may be splitting their time between any number of “must do” tasks. Often, the most talented employees are providing operational support, training junior resources, responding to questions or issues, handling audit requests and, time-permitting, supporting product development efforts. Those resources who are most critical to success often have little to no time to spend on strategic initiatives. At best, timelines are prolonged. At worst, inaccurate estimates are provided, timelines are missed and morale starts to take a hit.

Effective capacity management involves both up-front planning and back-end tracking. Management must provide a plan which demonstrates how the most important initiatives will be staffed in the realistic context of the team members’ overall responsibilities. On a regular basis, efforts should be tracked to confirm time is being spent as intended and, if not, obstacles should be removed to refocus on what is most important.

Consider an evolution in organization design

Often times, the organization is not structured for success. Removing barriers (physical, communication, organization, etc.) can greatly improve the success rate of product development projects.

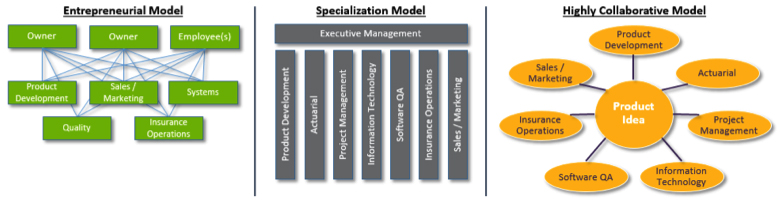

Recently, many insurance companies have been seeking successful methods for product ideation and process innovation, particularly from industries other than insurance. Successful project teams often extract top talent from their day-to-day responsibilities to focus on top strategic priorities, including product development initiatives. This is one component of evolution in organization design which is native to many large, yet innovative, organizations (see Figure 1 below).

Organizations in their infancy often have few employees who serve in multiple functions. While roles and responsibilities are not clearly defined, the organization is in rapid growth mode and “ownership” is shared by a handful of individuals highly committed to the organization’s success. It doesn’t matter who does what, as long as we have each other’s back and are moving forward. We’ll refer to this as the Entrepreneurial Model.

As the company grows, the owners can no longer handle the wide variety of functions needed to scale the organization. Employees are grouped into departments based on their area of specialization (e.g. sales and marketing, actuarial, information technology, insurance operations) – see Specialization Model. While this specialized structure leverages the strengths of individuals in the organization and creates operational efficiencies, it becomes inefficient in managing cross-functional projects like product development. Organizations become overly bureaucratic. Silos form and local leadership make locally optimal decisions at the expense of global outcomes. Key decisions get hung up in certain areas and progress must wait.

Successful product development, both inside and outside of the insurance industry, is the by-product of teams in which members identify and align more with a product than with their traditional department – see Highly Collaborative Model. Organizations, regardless of size, mimic the traits of the smaller entrepreneurial organization. Benefits, personally and professionally, are numerous. Teams and team members have minimal distractions and are empowered to adapt the process to their unique projects, rather than being held to a process ideal overseen by individuals distant from the value realizing work they govern. Decisions are made more efficiently or escalated more quickly to project sponsors. Morale is higher. And, as a result, commitment is higher, thereby increasing the likelihood of product and organization success.

Take a long-view on product configuration

Many carriers and policy administration vendors are migrating towards software solutions which benefit from a highly collaborative teaming structure. To understand this shift, it is important to understand the difference between configured solutions and developed solutions.

Most product development efforts require translating business requirements to functional design specifications, then to technical design, the development and test. Many product software development projects are challenged by multiple hand-offs, interpretations, stage gates, approvals, and controls. Even for effectively managed projects, this can take time to do well.

In a configured solution, a smaller team led by product managers, actuaries and project configurators work together to construct new or revised policies through a set of interfaces on the policy administration system. As the core policy administration system has been built for the purpose of reuse, configured products required no (or very little) custom development. As a result, the entire product development life cycle is reduced. There is no need to translate business requirements into code and, because the base software has already been tested, significant and costly test cycles are also greatly reduced. With newer solutions, most of the product development and pricing constructs are available right out of the box.

In-house developed, configurable solutions require an upfront investment in design and architecture. In the short term, this may result in delays to certain projects. However, the long-term, downstream benefits in speed-to-market, product throughput, and product quality will far outweigh the initial investment.

Integrate your digital strategy

As discussed in the previous article in this series, a number of factors are changing the way that insurance companies learn from and interact with their agents and their policyholders. These include both demographic shifts and lifestyle changes, as well as obtaining a better understanding of how customers prefer to be engaged and what drives purchasing decisions. The reality is that the way businesses interact with their customers, across all industries, is changing at a rapid pace. What constituted product development 10 years ago is different than what constitutes product development today…and we are only in the early stages of change.

This article is not intended to go into depth regarding all facets of a digital strategy. However, it is worth noting that it will no longer be enough to just have a great suite of products. Carriers will need to provide existing or potential policyholders with research that is meaningful, convenient, transparent and easy to understand. Carriers will also need integrated, omnichannel solutions to address the many ways policyholders choose to engage, including obtaining quotes, making payments, adding coverages, renewing policies and processing claims. Tomorrow’s customers will gravitate towards products which meet their needs, served to them in a manner which is most convenient to them.

Mind your product development processes and project management practices

Prioritization, alignment of organization structure, configurable tools and an overall go-to-market strategy will need to be supported by timeless fundamentals – a robust product development process and well-disciplined project management practices. This includes, but is not limited to:

- Governance and oversight – The product sponsor and delivery executives should have regular meetings to discuss realistic project status, risks and decisions.

- Clear ownership and responsibility – A project manager should provide day-to-day oversight over project team members with accountability and responsibility for delivering on their respective areas of the product.

- Common process and language – projects should have a defined taxonomy of terms to avoid a conflict resulting from vagueness (for example: does “complete” mean “final draft, ready for review” or “reviewed and ready for production”? This can be the difference between being on-schedule or behind schedule.)

- On-going status reporting – Project success factors should be defined up-front and measured on an on-going basis to confirm resources are working on the proper priorities and tracking to plan.

- Periodic stage gates – Rather than waiting until the project is near completion to have an executive review, schedule periodic requirements, design, prototype and build review sessions with key stakeholders.

Without exception, carriers want to deliver the right products to help their policyholders manage risk.

Once products have been identified, getting products to market in a timely manner and in a manner which is both convenient and meaningful to producers and policyholders is critical to maintaining and growing market share. Having the right focus, team structure, tools and medium for delivering projects is critical to success.